This post may contain affiliate links, which means we may receive a commission if you click a link and purchase something that we have recommended. This commission comes at no additional cost to you, but will help us keep this site up and running and ad-free! Thank you for all the support. You’re under no obligation to purchase anything and should only do so if the product will suit your needs.

In 2015, a study conducted by the National Foundation for Credit Counseling found that about ¼ of adults, largely between the ages of 18 – 34, miss paying their bills on time.

The study did not look at reasons why this is the case, but the chances are that organization (and lack of it) played a role.

Keep the late fees at bay with these helpful tips.

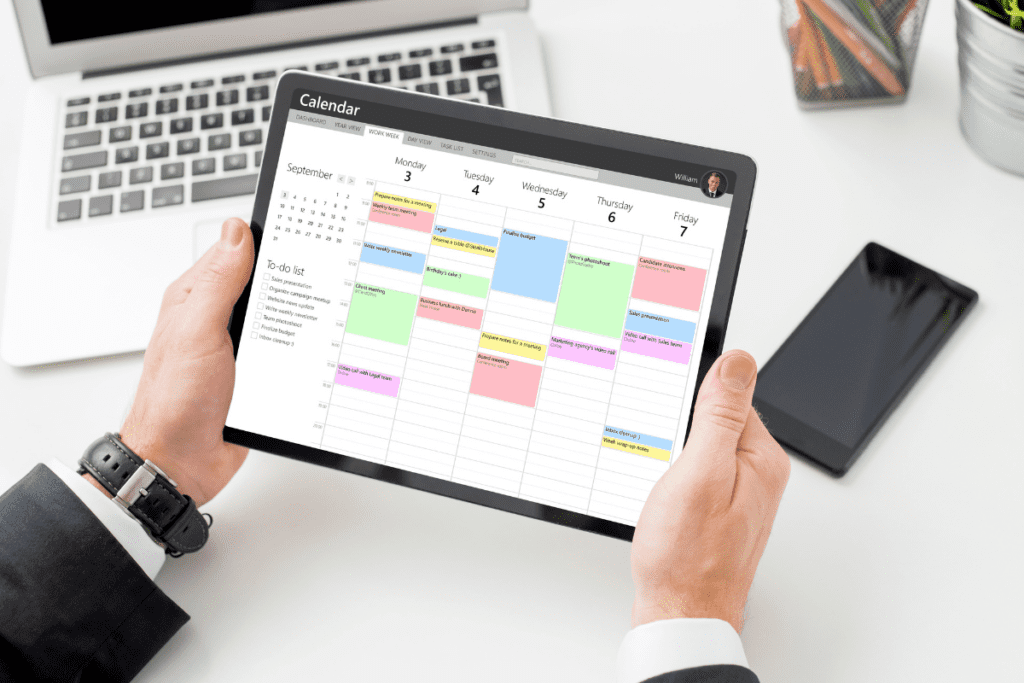

Create Lists

Keep a checklist of every bill you’re expecting to receive and when. Some bills are annual or bi-annual and can be easy to forget.

Be sure you’re noting which ones you pay automatically so you can be sure there’s enough money in your account.

Also, keep a running total of to date and estimate costs, so you never leave yourself short of funds.

![]()

Make a Schedule

Paying bills isn’t anybody’s favorite thing to do, but when you have a set day and time to do it and stick with it, they’ll be done and out of the way quickly.

Take Advantage of Automatic and Recurring Transfers

If you don’t see the money, you can’t spend it. So, create a monthly transfer into your savings account. You’ll be surprised how quickly your nest egg grows.

Affordable Care Act Myths & Truths

Keep it Organized

Set up a specific place to keep your bills, checkbook, postage, etc. You’ll save time and always know where everything is. To make it easier, check out Homezada!

Confirm Your Balance

Before paying any bills, confirm your balance and check that any outstanding direct deposits have arrived in your account.

Split Your Funds

If you’re anxious about paying your bills because you know you’re great at spending money, set up two accounts. Use one to pay your bills and one for other purchases.

All of this may take a little bit of time to set up, but what you’ll save and in late charges and overdraft fees makes it worth the effort.