For many people, budgeting can be tedious and stressful. It seems easier to avoid it – and in the short term, it may be. But you know that long-term you need to have a budget. Thankfully, it’s a lot easier to create a budget with the help of some great apps. No more tearing your hair out in front of an Excel spreadsheet – try one of these specialty apps instead.

You Need a Budget (YNAB)

YNAB is hugely popular and super easy to use on both Mac and Windows platforms. In addition to being easy to use, YNAB teaches budgeting skills. The designers created this app for beginners so that you won’t be faced with a lot of tools and features you don’t understand. As a bonus, you can sign up for online classes. One of my favorite features in YNAB is that it alerts you if you’ve strayed from the budget you set up.

Quicken

Quicken is probably the longest-running budgeting app around. It’s been around since 1983! While it sets the standard and does everything you expect a budgeting app to do, it’s also a bit old-fashioned. For example, it doesn’t auto-sync to your bank accounts, nor is it cloud-based. If those things aren’t important to you, Quicken can be a great option. *UPDATE- Quicken now has a web version that allows bank accounts to sync and access the cloud. FINALLY!

PocketGuard

This “budget-friendly” app is great for anyone new to budgeting or students just starting their budget. PocketGuard’s In My Pocket feature instantly shows cash available to spend, and an intuitive pie chart helps beginning budgeters see if they’re on track. An Autosave feature enables young budgeters to set up automatic savings plans.

CountAbout

There are two versions of CountAbout: basic and premium. While they both connect to your banking institution (including Quicken and Mint), you need to do it manually in the basic version. Unlike many other budget apps, you can’t pay your bills online with CountAbout, and there’s limited ability to manage your investment accounts.

Tiller Budgeting App

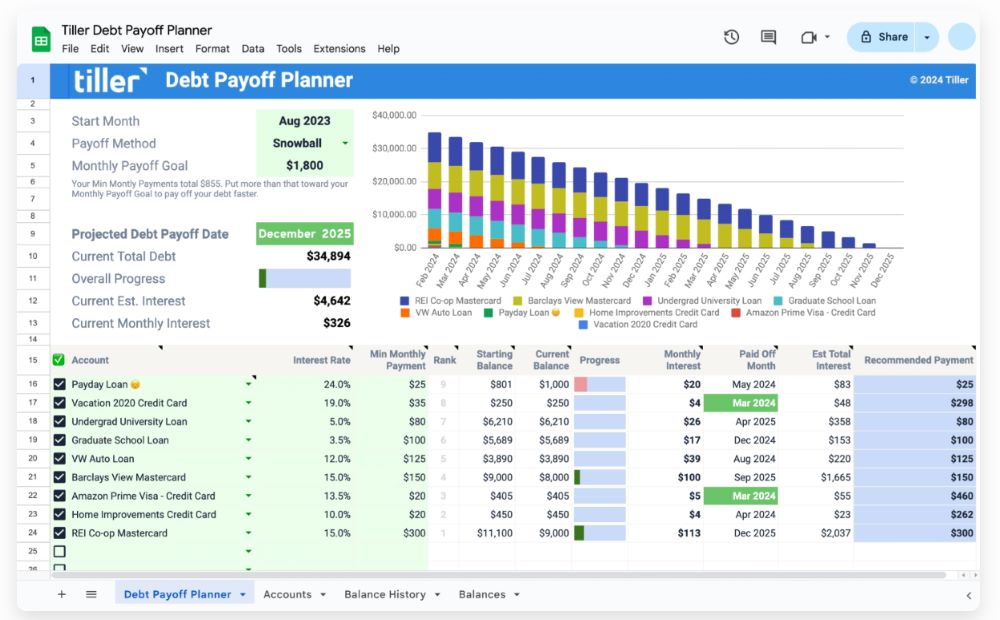

Tiller is a comprehensive financial management platform that offers customizable and flexible spreadsheet templates for personal finance tracking. It connects directly to your bank accounts, automatically updating financial data in Google Sheets or Excel, providing a real-time, comprehensive view of your finances. Ideal for those who prefer a detailed approach to budgeting, Tiller allows users to manage budget categories, track investments, and set financial goals efficiently. Additionally, Tiller enhances user convenience with ad-free experiences and daily email summaries, keeping users consistently informed about their finances. Find out more about Tiller and their NEW Debt Payoff Planner.

Empower (formerly Personal Capital)

Empower provides a comprehensive suite of financial services for personal investors, focusing on wealth management, socially responsible investing, and personalized investment strategies. Their offerings include wealth management for clients with substantial investable assets, options for aligning investments with personal values, and methodologies for risk minimization and portfolio diversification. Empower also offers high-interest cash accounts with significant FDIC insurance, a variety of IRAs and investment accounts for different financial goals, and an array of financial tools such as retirement planners, net worth calculators, and budget planners. These services are tailored to assist clients in achieving their financial objectives through strategic saving, investing, and professional guidance.

You can use the basic version on your Android or iOS device completely free. Millions of people use this app to understand their financial habits, analyze the fees associated with their retirement plans, and get personalized suggestions for allocating their assets. Try it here.

Acorns

When you make a purchase, chances are it’s not in whole dollars. When people paid cash, the change wound up in a jar and was saved for a big purchase – like a fancy dinner or mini-vacation. Acorns does essentially the same thing, but digitally.

Using one or several of these apps makes budgeting easier and helps you grow your personal wealth. What’s not to love about that?