A growing number of Americans are retiring and aging without a spouse or adult children to help them. In fact, research by Dr. Maria Torroella Carney, chief of geriatric and palliative medicine at Northwell Health in Great Neck, New York, states that 22% of people over 65 are “solo seniors” or “elder orphans.” And that number is only going up.

In 2016, Carol Marak set out to make life easier for these people. She started the Elder Orphans Facebook group. Far more than a place to whine and gripe, this group provides much-needed socialization and an infrastructure of people to rely on. If you’re not on Facebook (and don’t want to be), you can create an infrastructure for yourself.

How to Thrive as a “Solo Senior”

Have a Buddy System

More than half of seniors without family have no one to call if they’re confined to bed or drive them to/from appointments if needed. Think about moving to senior housing or establishing friendships with your neighbors if you’re unwilling to give up your home. Let them know you don’t have family and would appreciate them helping you occasionally.

Connect in the Community

This could be anything from weekly religious services to community center games or volunteering. It doesn’t matter. Pick something you’ll do regularly so people will be concerned if you’re not there.

Why?

It gives you something to look forward to and guarantees you someone will check on you if you don’t show up.

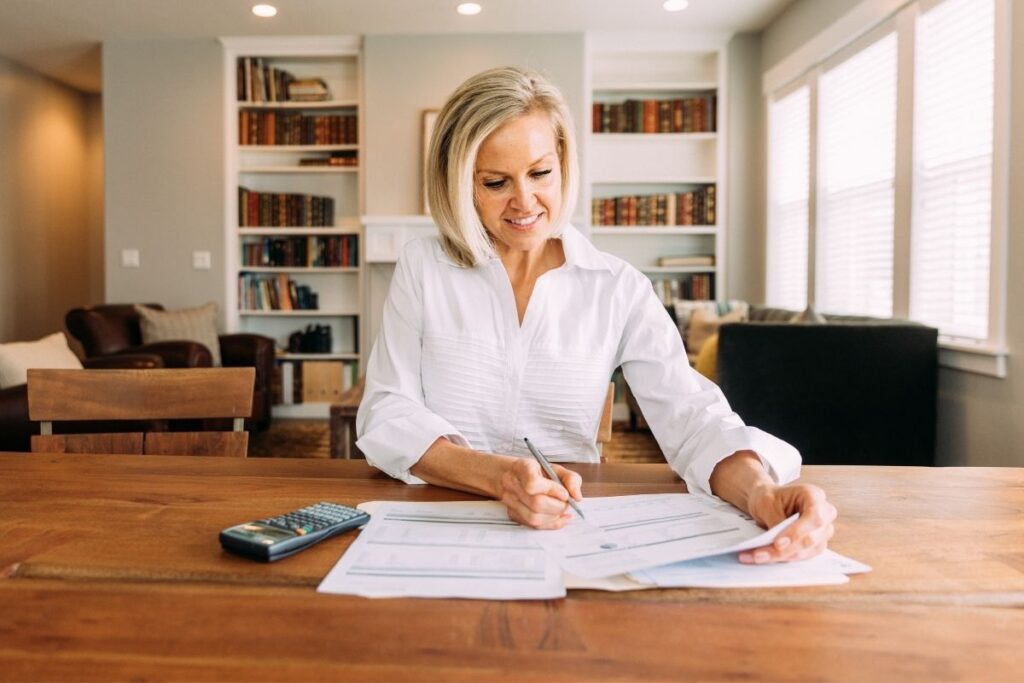

Set Up Safeguards

It’s essential to have a plan in place before you need help. Think of professionals (social workers, daily money managers, or caregivers) you might need in the future. Establish a relationship with them now and keep in touch. That way, when you need help, it will already be there.

Other Considerations

Included with this should be a power of attorney and health care proxy. One additional precaution to consider – carry a card in your wallet with the contact info for your PCP and a list of current medications and dosages.

Estate Planning

This is more than setting up a will. Pick someone to legally act on your behalf in financial matters if you can no longer do so. Also, consider purchasing long-term care insurance to cover the costs of home health aides and/or nursing home care. Without insurance, these costs add up quickly. Another way to protect your assets is to put them in a revocable trust.

Planning now means aging without a family to help you won’t be scary or challenging to navigate.

Sign up for our Newsletter and get more like this!