As the tax season rolls around, it’s essential to be well-prepared, regardless of the year. Whether you’re enjoying retirement, managing significant wealth, or balancing the needs of both children and aging parents, understanding your tax obligations is crucial. Let’s explore what you need to know to navigate tax season easily every year.

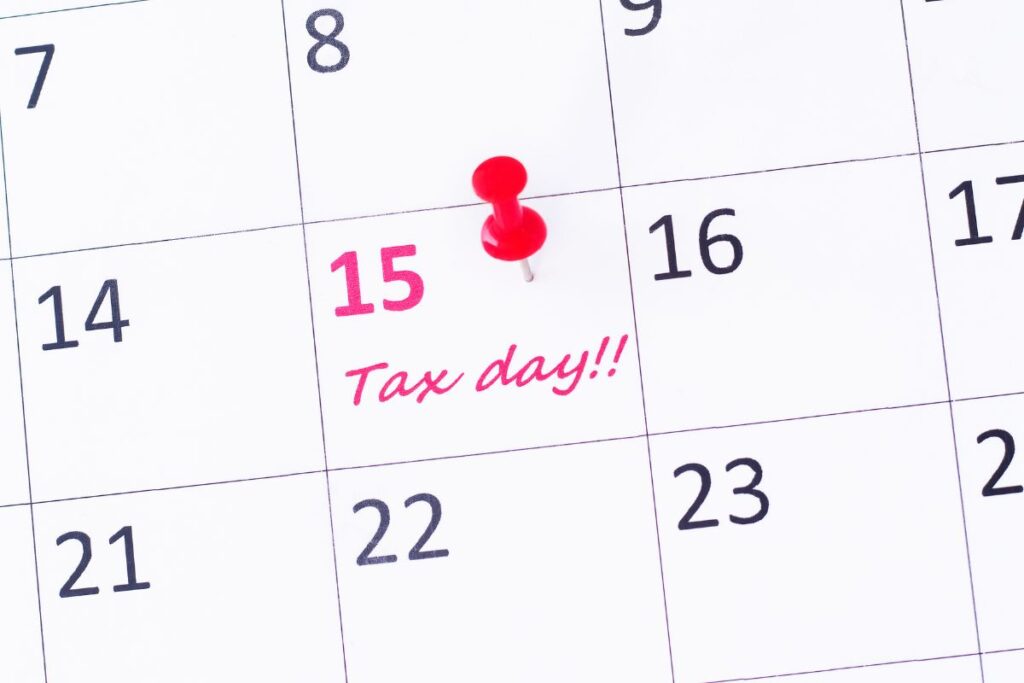

Getting an Extension

Life can be unpredictable; sometimes, you need more time to file your taxes. It’s important to remember that while you can file for an extension, this only applies to the paperwork. Your estimated tax payment is still due by the standard mid-April deadline. If you opt for an extension, ensure your complete filing is submitted by mid-October.

Consider a retiree who has recently ventured into consultancy. An extension can provide the extra time needed to organize various income statements, but the estimated tax due still needs to be paid.

Small Business Owners and Quarterly Payments

For those who are self-employed, managing taxes means making quarterly payments. This involves submitting the 1040 form every quarter, reflecting earnings from the previous three months. Delaying these payments until April can lead to penalties, so staying ahead is vital. (Experts recommend setting aside 15% to 30% of your profits for taxes as a general guideline. However, the exact amount to save depends on your specific taxable income and filing status)

Example: John, who owns a small landscaping business, diligently follows the guideline of saving 25% of his profits for tax purposes. He understands that his tax liability depends on his business’s income and his personal filing status. John deposits these funds into a High-Yield Savings Account (HYSA) to make the most of his tax savings. This approach ensures he has enough set aside for his quarterly tax payments and allows his savings to accrue additional interest, providing a modest but meaningful boost to his financial planning.

Special Tax Situations

Life’s unexpected events, like natural disasters, can influence your tax deadlines. The IRS may offer extensions in such scenarios. Additionally, living abroad at tax time can grant you an automatic two-month extension, though interest on any due tax still accrues.

Organizing Your Taxes

Staying organized is key. If you haven’t been tracking tax-related information all year, now is the time to start. Working with a professional can significantly ease this process. Always consult with a tax professional for any specific queries.

Tax Organization Checklist

- Compile all income statements (W-2s, 1099s, etc.)

- Summarize deductible expenses

- Track charitable donations

- Organize receipts for credits and deductions